Despite an economic backdrop of a high base rate, there has been an increase in new instructions across both sales and lettings. While 50% of properties were discounted, in the broader picture, this is just 2% more than pre-pandemic reductions.

As we enter the second quarter of the year, it’s time to look at property data from the start of the year to now, to inform our opinions and advice on the prime London housing market.

Key takeaways

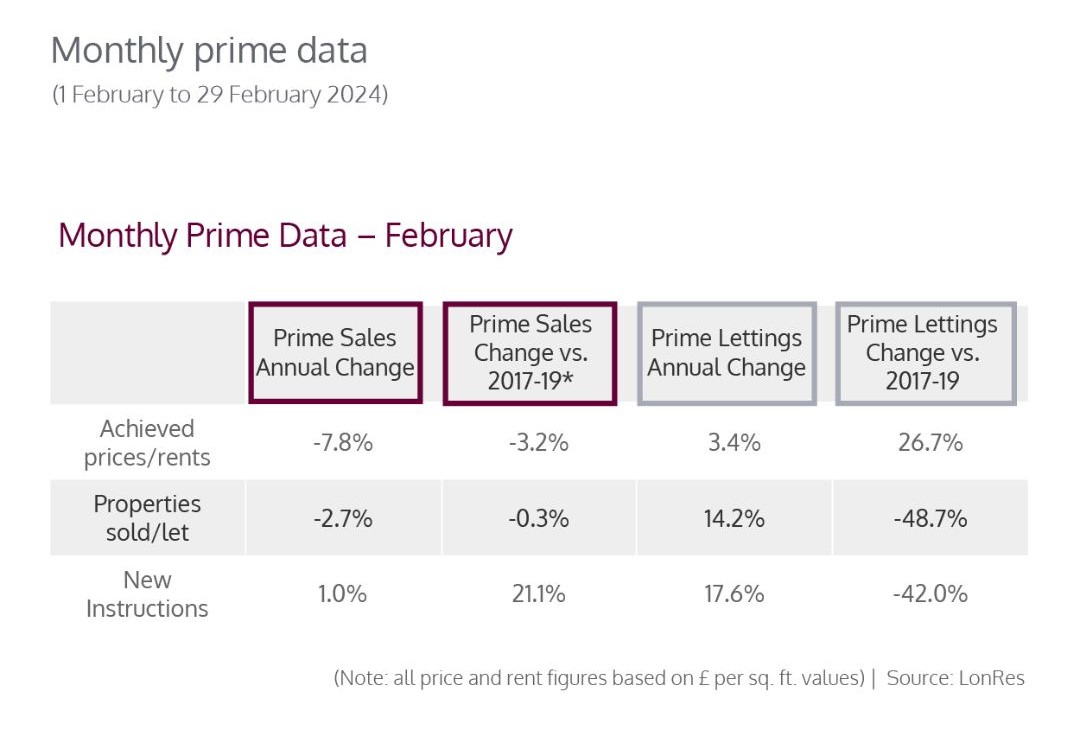

- New instructions rose in February by 1.0% on an annual basis

- In the last year, around 50% of properties saw a discount in price, which is 2% more than in 2017-2019

- Average rent in London currently sits at £2,119 after a 6.4% growth in the last year

- Sales of £5m+ homes were up 4.2% on February 2023

Economic Outlook

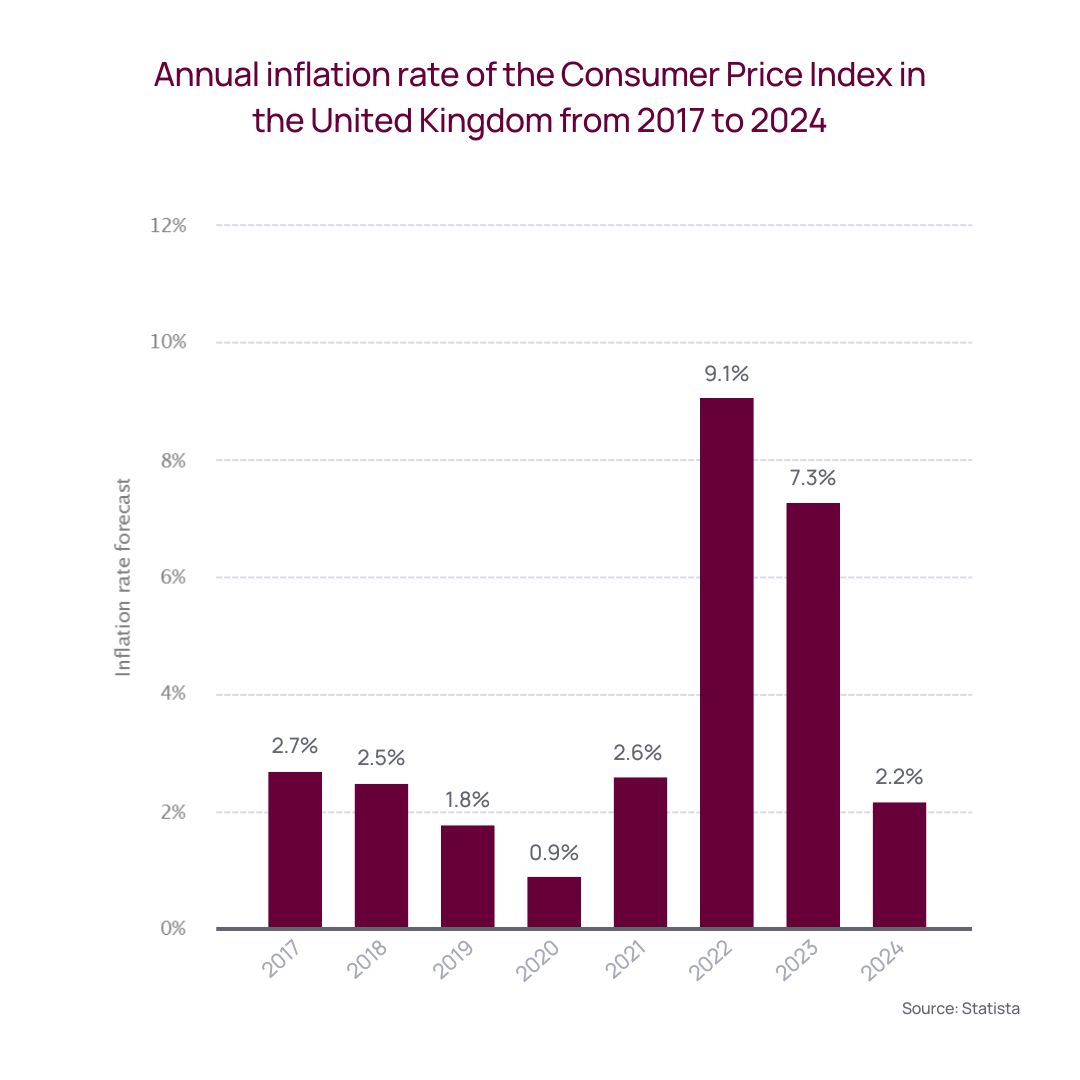

In March 2024, the Bank of England held the base rate at 5.25%. Rates are predicted to fall to 4.4% by the end of 2024. With the inflation rate at 4.8% and forecast to reach 2.2% this year, sellers and buyers can have more confidence in the housing market – particularly if they require a mortgage. Landlords may feel relief as cost of living declines, reducing the financial strain on stretched tenants.

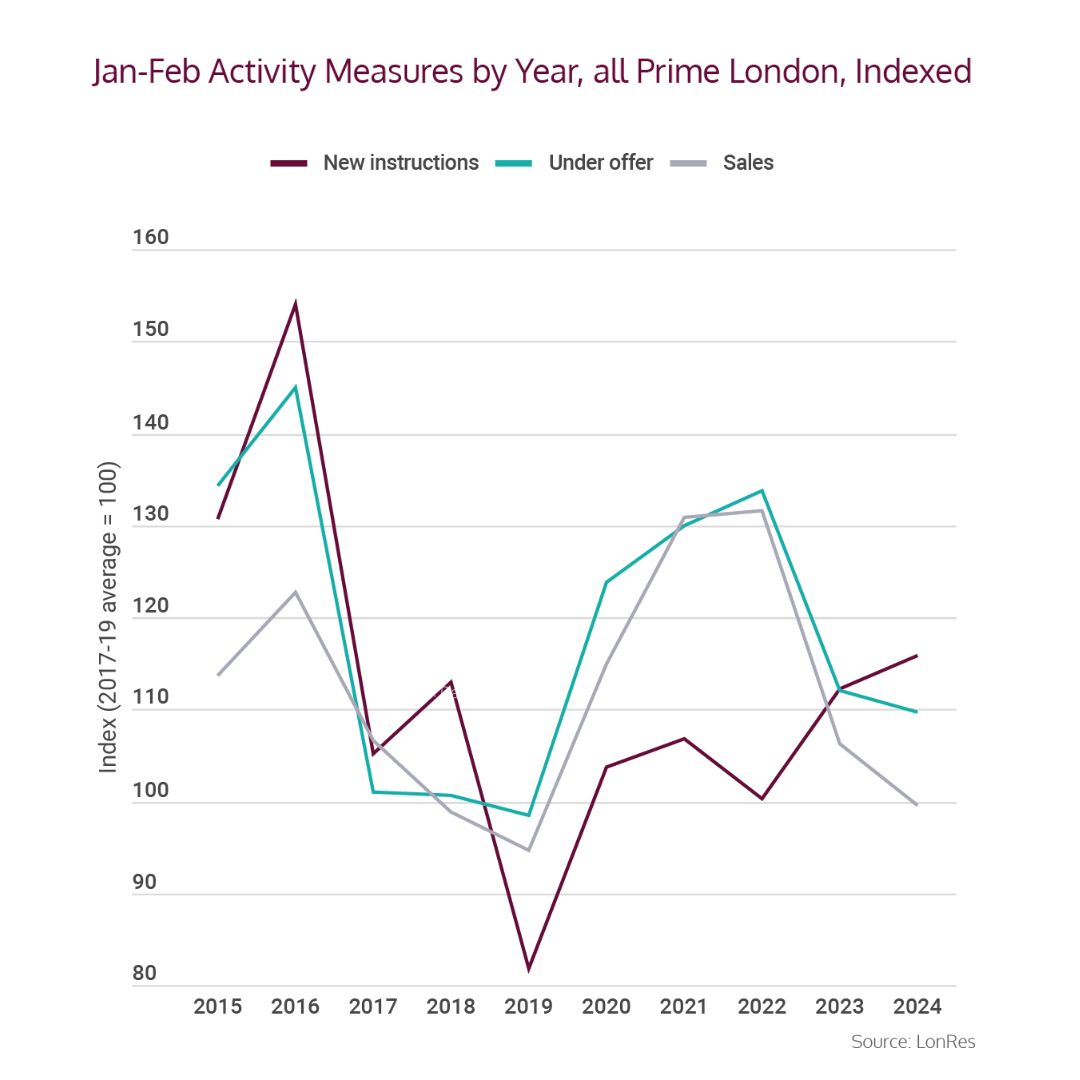

A Positive Start For New Instructions

Spring is a prominent time for a flurry of properties coming to market. This year has continued to endorse the trend as properties for sale in prime London rose in February by 1.0% annually. This is evidently 20% higher than the 2017-2019 average. By the end of the month, there were 7.5% more properties available in February 2024 than in the same month of 2023. Under offer numbers are around 10% higher than last February. This is a positive sign for those looking to make a move this summer.

While demand remains static, the gradual increase in supply means the prime London sales market remains relatively balanced.

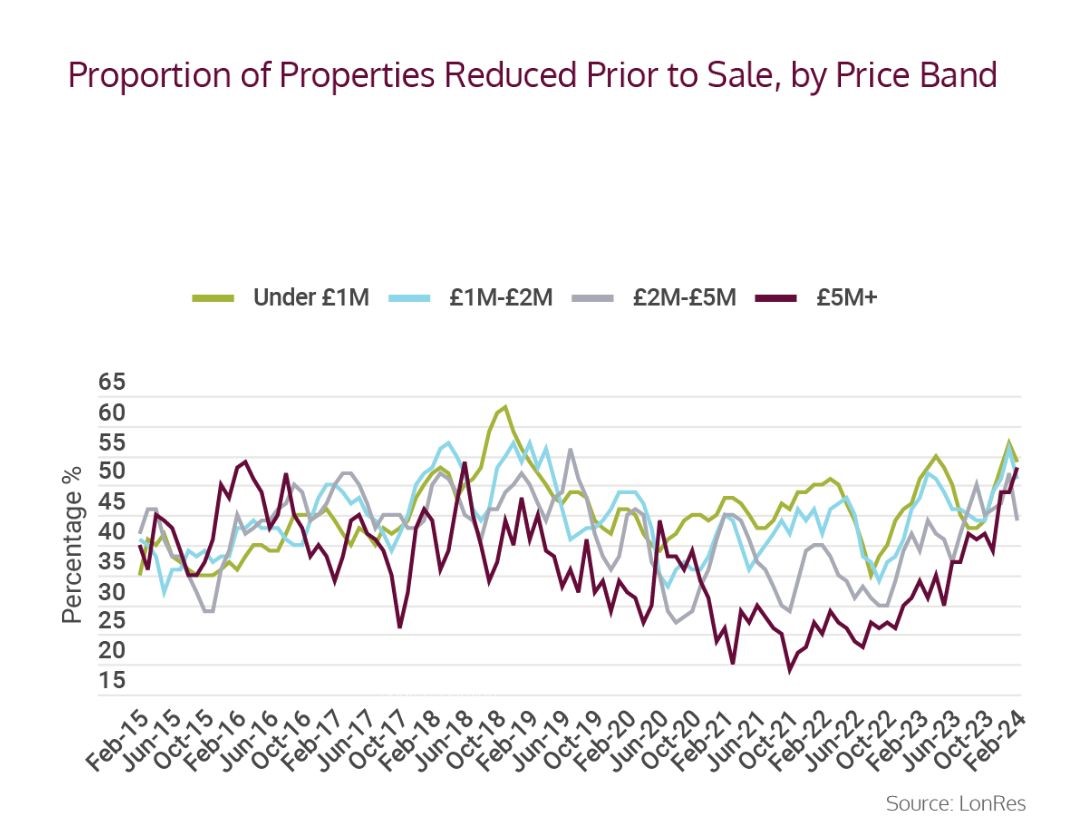

Discounts Remain Consistent

Analysing the data on price reductions and time to sell indicate the current market position. With a broader view of the data, the metrics aligned with trends. In the last year, around 50% of properties saw a discount in price, which is 2% more than in 2017-2019.

In the prime London market, sellers received an average of 91.4% of the sale price. This is an increase of 1.4% in January when the figure fell below 90%. Pre-pandemic average discounts were around 10%, so on a broader outlook, the price reductions held firm.

Average time on the market has also remained stable. Across prime London in February 2023, the average time from listing to exchange was 166 days. Since 2017, this figure has moved from 165 and 164 days, showing long-term consistency.

A Broad View Of The £5m+ Market

While sales of £5m+ homes were up 4.2% in February 2023, properties under offer were 11.5% lower. However, an accurate picture of the £5m+ market requires a broader view rather than focusing on small market segments.

Analysing January and February 2024, the £5m+ market appears weaker. During this time, price reductions and new instructions were rising, and transaction volumes were declining. Currently, there are 26% more £5m+ properties on the market in London than in 2023. However, when you look at the bigger picture, activity in 2024 is significantly higher than 2017-2019. Sales in the £5m+ market are up more than 40% compared to pre-pandemic.

Increase In Annual Rental Growth For Investors

In the prime London lettings market, we are seeing the first signs of spring. In February, we saw annual rental growth increase across the prime London lettings market. There was a slight rise of 3.4%. This increase boosts values by 26.7% above their 2017-2019 average. After four months of falls, this is welcome news to property investors and landlords.

Rental Income Remains High

Zoopla reports that London is the most expensive location to rent in the UK. Average rent in London currently sits at £2,119 after a 6.4% growth in the last year. The most expensive places to rent are Kensington and Chelsea at an average of £3,460, and the City of Westminster at £3,153.

New Instructions

While we’ve seen many landlords exit amid tax changes and interest rate increases, new instructions are starting to rise as new investors enter the market. In February 2024, there was an increase of 17.6% in instructions on an annual basis. This remains 42% below the pre-pandemic level. However, across prime London, there are 48.1% more properties on the lettings market than in 2023, indicating a trajectory.

Discounts And Demand

In Q3 2022, discounts and price reductions were at an all-time low. This denotes that demand was notably outstripping supply. In February 2024, the average discount was 4.2%, compared to -0.5% in September 2022. With supply now on the rise, we are also seeing reductions in price, with 35.1% of properties being reduced before the let was agreed.

With high-interest rates pushing up the cost of borrowing for potential buyers, buyers may turn to renting as an alternative, increasing the demand for rental properties. Should interest rates begin to fall later in the year, the rental market may begin to stabilise.

The Impact Of New Legislation For Landlords

With the Renters Reform Bill on the horizon and the government’s commitment to requiring all rental properties to have an EPC rating of A-C, landlords do have challenges to navigate. Landlords may be required to enhance the property, and may increase rent to pay for required works. The looming general election also adds uncertainty. However, with increased demand for rental properties, high yields, and the weak pound, there are opportunities to be sourced for overseas and local investors.

Final Takeaway

We’re seeing the first signs of spring in the prime London sales and lettings market. From an increase in new listings across sales and lettings to a stabilising of discounts and price reductions, there are plenty of opportunities to invest, buy, and let with confidence.

Contact our Central London estate agents office to discuss the opportunities in the prime London housing market, hear about house price changes, and view properties for rent and sale.